Heloc with poor credit

Find the right lender for you on our expert-reviewed list. 250000 X 80 200000 200000 180000 20000.

Home Equity Loan Vs Personal Loan Which Is Better For You Home Equity Loan Personal Loans Home Equity

Getting instant credit card numbers allows you to expand your credit card before getting your physical card.

. A mortgage rate is the interest rate you pay on the money you borrow to buy property. The best mortgage lenders for bad credit offer low rates low down payment requirements fast closing and more. After all a credit score is a common indicator of whether a borrower is a risk.

1000 to 50000 Repayment terms. The interest rate depends on the type of loan the borrowers credit score and if. For example if you have a home valued at.

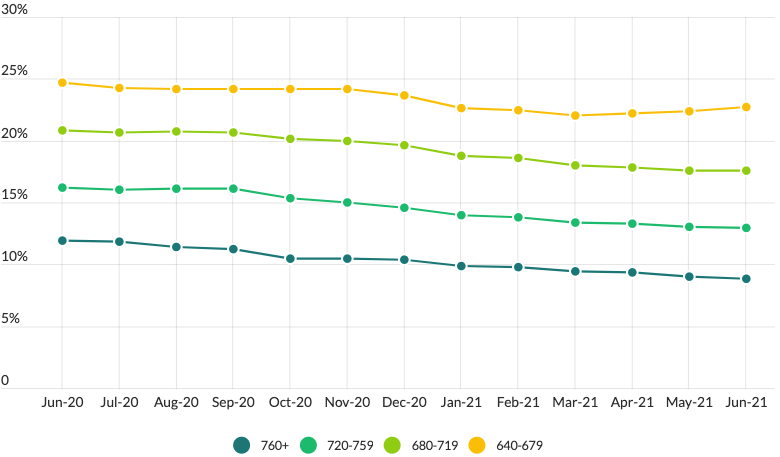

Generally as long as you stay under that credit limit you can borrow as much as you need any time you need it by writing a check or using a credit. Unisons 620 credit score minimum may exclude interested homeowners whose credit may already be too low for traditional home lending options. People with an excellent credit score of above 760 will get the best rates.

What one lender may consider a good score another may consider poor or even risky. Lenders will pay special consideration to an investors credit score when evaluating a HELOC as with most other sources of capital. Most draw periods are between 5 and 25 years.

Best for borrowers with no credit or poor credit. Emergency credit line. READ MORE What Roof Financing Options Are Available.

The good news for people that have a manufactured or modular home is that the credit standards and rules are changing for fixed and HELOC loans and cash-back refinancing. Compare the options available for new roof financing like home equity loans cash-out refinance and more and determine which. This must be said.

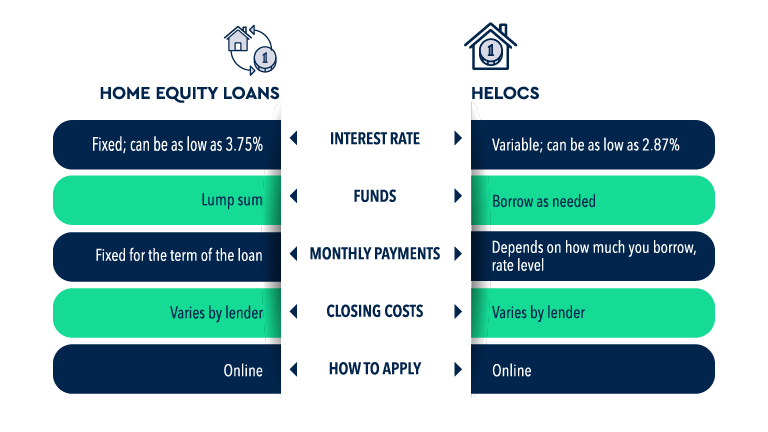

When you close an account it can reduce your average account age. Learn the ins and outs of a home equity loan vs. Payments do not include amounts for taxes and insurance premiums.

As mentioned above banks typically allow a max LTV of 70 to 85. Up to 84. The higher your credit score the lower your interest rates.

Bankrates experts compare hundreds of top credit cards and credit card offers to select the best in cash back rewards travel business 0 APR balance transfer and more. Cash-out auto loans may charge a nominal processing fee and you can expect an APR of up to 24 if you have bad credit. Unison Competitors and Alternatives.

In general a credit score of between 670 and 739 is considered good. Cards for people who are new to using credit or who have poor credit may have low credit limits of 500 or lesswhile individuals with excellent credit may have credit limits close to 20000. Private student loans on the other hand will often do a credit check and set interest rates according to your creditworthiness.

Traditionally borrowers will want. When it comes to the credit score. Compare todays mortgage rates for purchase and refinance and lock in the best deal on your home loan.

Anyone can rebuild credit after suffering bankruptcy by applying for a credit card designed for people with poor or bad credit. Let Bankrate a leader. To figure out how much your credit limit would be on this HELOC multiply your homes value by 80 and subtract your current balance.

For example if you have very poor or fair credit a credit score that ranges from 300 to 669 your estimated APR could be between 178 percent and 32 percent. A HELOC may charge subprime borrowers. 15000 to 750000 up to 1 million for properties in California.

The demand for mobile home equity lines of credit and loans has surged in 2020. Once approved for a HELOC you can borrow up to your credit limit whenever you want during that period. The interest rate will vary based on a publicly available index such as the prime rate or a US.

This type of financing also known as a HELOC is a revolving line of credit much like a credit card except it is secured by your home. HELOC Home Equity Loan Qualification. The credit limit corresponds to the amount of equity you have in your home.

And if the card comes with a 0 intro APR period you get an even higher value. The three primary things banks look at when assessing qualification for a home equity loan are. Updated July 6 2021.

Available equity in the home. With responsible spending and on-time payments youll watch your. Now that weve covered Unison in-depth lets compare it against these companies.

A home equity line of credit HELOC to decide which option is best for your financial goals. If you have a poor credit score or history it will be very difficult for a lending institution to extend you a LOC. HELOCs may have a minimum monthly payment due similar to a credit card or you may need to pay off the accrued interest each month.

Before You Apply Minimum FICO credit score. For those with poor credit a financial emergency can be twice as devastating as obtaining an emergency loan will often be much harder than it would be for consumers with good credit. Click here for more information on rates and product details.

Unisons three primary competitors are Hometap Noah and Point. Less-optimal borrowers such as those with poor credit scores or high debt-to-income ratios would be able to access less than 85 of their home equity. The lender approves you for a certain amount of credit.

Keep credit cards open unless you have a compelling reason for closing them such as an annual fee or poor customer service. Those with good credit. Data provided by Icanbuy LLC.

Many borrowers in their first experience securing a loan for a new home automobile or credit card are unfamiliar with loan interest rates and how they are determined. Scores between 580 and 669 are considered fair and anything below 580 is considered poor. Home Equity Line of Credit - Rates are based on a variable rate second lien revolving home equity line of credit for an owner occupied residence with an 80 loan-to-value ratio for line amounts.

Find out who does home equity loans on manufactured homes. Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. You can withdraw HELOC funds at any time during the draw period defined by your lender.

This is helpful if you need to make a large purchase and dont have available credit on your other cards.

If You Want To Pay Off Your Mortgage Early In Five To Seven Years You Can Using A Simple Home Equity Line Of Credit Also C Line Of Credit Home Equity Heloc

If You Want To Pay Off Your Mortgage Early In Five To Seven Years You Can Using A Simple Home Equity Line Of Credit Also C Line Of Credit Home Equity Heloc

Schwab Bank S Investor Advantage Pricing Offers Mortgage Rate Discounts On Home Loans Refinance Mortgage Mortgage Mortgage Loans

Pin On Personal

Homeowners Are Sitting On A Record 6 Trillion In Equity Why Aren T They Using It Home Equity Equity Line Of Credit

3 Best Providers Of Home Equity Loans For Bad Credit Badcredit Org

Pin On Refiguide

How To Get A Heloc With Bad Credit Easyknock

Mortgages And Loans Mortgage Tips Real Estate Tips Home Buying

![]()

Schwab Bank S Investor Advantage Pricing Offers Mortgage Rate Discounts On Home Loans Refinance Mortgage Mortgage Mortgage Loans

Can You Get A Heloc With A Bad Credit Score Credello

Why You Should Use A Broker Remaxpr Mortgage Brokers Mortgage Advice Mortgage

Home Equity Loan Vs Personal Loan Which Is Better For You Home Equity Loan Personal Loans Home Equity

Heloc Loan Requirements Heloc Loans Heloc Loan Heloc Line Of Credit

Can You Get A Heloc With A Bad Credit Score Credello

Home Equity Loan Vs Personal Loan How They Compare

Easy Way To Get A Home Equity Loan With Bad Credit Your Equity